Whether you are an investor or a statistical expert, you might be familiar with the importance of risk management in the finance industry. A minor mistake in making a decision can lead to major financial loss.

Therefore, nearly all experts in the investment sector always try to stay vigilant of potential hurdles. For this purpose, they often use different key metrics to keep an eye on complex statistical datasets. Standard deviation is also one of those metrics that enable them to sneak into future risks.

It greatly contributes to helping professionals determine what financial challenges they may have to face and keeps them safe from suffering major losses. In this guide, we will discuss how standard deviation helps them perform risk analysis.

However, before delving into this debate, let’s first briefly overview standard deviation.

Standard Deviation — A Brief Overview

According to Investopedia, standard deviation refers to the distance of all points of a dataset from the mean. To put it simply, it is the measure of variation in the location of all points of a dataset around its mean value.

An important thing to remember is that the higher the distance is from the mean point, the greater the deviation will be. Conversely, the closer the points are to the mean value, the smaller the standard deviation.

Here is the mathematical representation of standard deviation:

Standard Deviation = √ Σ (xi – x)2 / n – 1

In the above equation, xi represents the value of the ith point, “x” shows the mean of the dataset, and “n” refers to the total number of points.

Importance Of Standard Deviation To Financial Risk Analysis

Standard deviation contributes in different aspects to shield financial experts and companies from prospective challenges. Here are the key areas where standard deviation comes to help you:

Measuring Investment Volatility

Standard deviation plays an important role in measuring the volatility of an asset’s returns. The higher the value of the standard deviation, the greater the fluctuation. On the other hand, the low values of this metric show that there will be less variance in the prices.

This key metric helps investors figure out how much the asset’s price can fluctuate over time. Large fluctuations frequently result in larger risks because they may entail an extreme decrease in prices. That’s why, by calculating the standard deviation timely, experts can avoid investing in stocks that may fluctuate greatly over time. It helps them buy the assets that align with their risk tolerance.

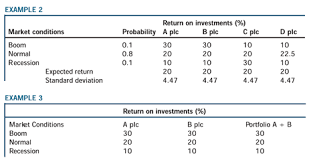

Comparing Investment Options

Imagine you are asked to invest one of the two assets with the same possibility of returns. How would you decide which option is the best for you? This is where standard deviations come in handy. It enables you to compare different investment opportunities based on the risk involved.

To make the right decision, just calculate the standard deviation for both options and check what values you get. The low value means lesser risk and the higher value means greater risk. By choosing to invest in an asset that has a low standard deviation, you can remain safe from bearing any major financial loss.

Diversifying Overall Portfolio

As an investor, you might know how important it is to maintain a stable investment portfolio. Poor volatility of a single asset can badly impact the overall portfolio. Standard deviation proves highly beneficial in keeping your portfolio free from major fluctuations. It helps you analyze and correlate risks associated with each investment option. By ensuring the lowest possible overall standard deviation value, they can make sure that their portfolio remains sustainable.

Calculating the standard deviations for individual assets can help investors prioritize assets that have lower chances of loss. By making wise investment decisions, they can enrich their portfolio with profitable assets, allowing them to balance risk with returns.

Best Way To Calculate Standard Deviation

When it comes to calculating standard deviation, most experts are only familiar with manual methods. Although you can perform calculations using the formula of standard deviation, this method is a bit complex and involves risks. While calculating, you might fall victim to unintentional accuracies that may lead to wrong results.

So, you should opt for the more accurate alternative, which is using an online standard deviation calculator. It not only reduces your efforts but also provides you with more precise outcomes, reducing the probability of potential errors that you might make in manual calculations.

A digital calculator designed to compute standard deviation utilizes advanced algorithms to generate error-free output. You just need to input the correct values of the given dataset into the tool. Within seconds, the results will be on your screen.

Wrapping Up

To put it in a nutshell, the calculation of standard deviation enables investors to invest in the most profitable assets. Above, we have thoroughly explained how it contributes to lowering financial risks. We hope that you will always calculate the standard deviation before investing in any asset.